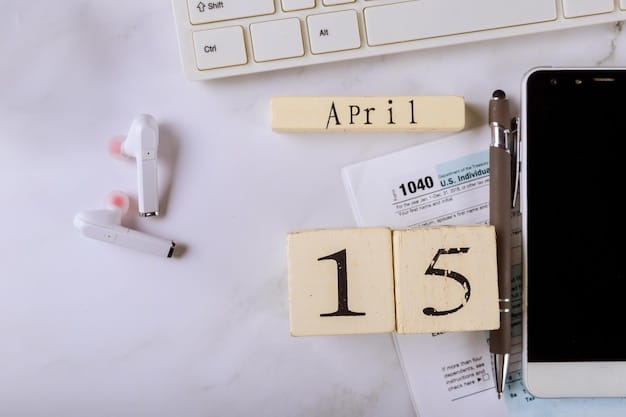

New IRS Guidelines 2025: Itemized Deduction Changes & Tax Impact

New IRS guidelines for 2025 bring significant changes to itemized deductions, potentially impacting taxpayers by altering deduction limits, eligibility criteria, and the overall tax liability for individuals and families in the US.

Navigating tax season can feel like traversing a complex maze, and understanding changes to itemized deductions is crucial for optimizing your tax return. The new IRS guidelines for 2025: What changes to itemized deductions mean for your tax return could significantly impact your financial planning.

Understanding the Basics of Itemized Deductions

Itemized deductions allow taxpayers to reduce their taxable income by claiming eligible expenses. These deductions cover various areas like healthcare, homeownership, charitable donations, and more. However, with the ever-evolving tax landscape, staying informed about the latest changes is paramount.

Understanding itemized deductions can be the key to significant tax savings. By knowing which expenses qualify, you can legally lower your tax bill and potentially increase your refund. Let’s delve into the essentials of these deductions.

What Are Itemized Deductions?

Itemized deductions are specific expenses that taxpayers can claim on Schedule A of Form 1040 to reduce their taxable income. These deductions are claimed instead of taking the standard deduction, and you should choose the method that results in the lower tax liability.

Common Itemized Deductions

Several expenses can be itemized, provided they meet IRS criteria. Some of the most common include:

- Medical and Dental Expenses: Costs exceeding 7.5% of your adjusted gross income (AGI).

- State and Local Taxes (SALT): Limited to $10,000 per household, including property taxes, state income taxes, and sales taxes.

- Home Mortgage Interest: Interest paid on mortgage debt up to certain limits, often depending on when the mortgage was taken out.

- Charitable Contributions: Donations to qualified organizations, typically limited to a percentage of your AGI.

By understanding these basics, taxpayers can better prepare to optimize their deductions and minimize their tax burden. It’s essential to keep thorough records and receipts to support your claims.

Understanding the foundations of itemized deductions empowers taxpayers to make informed decisions and potentially save money. Keeping up with these basics is a proactive approach to financial well-being.

Key Changes in the 2025 IRS Guidelines

The IRS periodically updates its guidelines and regulations, and 2025 is no exception. Several key changes could affect how taxpayers approach itemized deductions. Understanding these changes is crucial to accurate tax planning and compliance.

The new IRS guidelines for 2025 introduce modifications to certain deductions, eligibility criteria, and possibly deduction limits. These shifts require taxpayers to adapt their strategies and ensure they align with the updated rules.

Updates to Medical Expense Deductions

The threshold for deducting medical expenses remains at 7.5% of AGI. However, the IRS has clarified certain eligible expenses and documentation requirements. Taxpayers should remain well-informed about these changes.

Modifications to the SALT Deduction

While the SALT deduction remains capped at $10,000, the IRS may provide further guidance on the types of taxes that qualify. Be sure to review any updates concerning state and local tax deductions.

- Eligibility for Certain Deductions: Verification of eligibility criteria has been updated.

- Documentation Requirements: The kind of paperwork required for deductions has been revised, demanding greater meticulousness.

- Impact on Tax Liability: It may affect your overall tax liability based on the changes implemented by the IRS.

Staying informed about modifications to itemized deductions is a critical component of tax preparation. Staying updated on these revisions could help ensure accuracy and compliance in future filings.

Keeping abreast of these crucial changes can empower taxpayers to make well-informed choices, ensuring adherence to the latest regulations. Accurate tax planning is achievable when taxpayers are well-informed and compliant.

Impact on Different Income Levels

The implications of new IRS guidelines for 2025 can vary significantly depending on a taxpayer’s income level. Understanding how these changes affect different income brackets is crucial for tailored tax planning.

Some income levels could experience greater benefits, while others might face limitations or reduced deductions. This section explores how these changes might differentially impact taxpayers across different income spectra.

Lower Income Levels

Taxpayers with lower incomes may find that changes to itemized deductions have a minimal impact. Many in this bracket opt for the standard deduction as it often exceeds their itemized expenses. However, increases in credits and targeted deductions could prove beneficial.

Middle Income Levels

Middle-income taxpayers could experience a more pronounced impact, especially those who meticulously itemize. Changes to deductions for mortgage interest, charitable contributions, and state and local taxes must be closely evaluated.

Understanding how changing itemized deduction rules impact various income levels can provide valuable tax-planning insights. Consult a tax professional to assess your individual impact.

Understanding these varied impacts allows for personalized tax planning and strategies. Awareness of how the new guidelines affect different income brackets is a key element in tax accuracy and management.

Strategies for Maximizing Itemized Deductions

Despite changes to itemized deductions, several strategies can help taxpayers maximize their savings. Careful planning and informed decisions are key to optimizing your tax return under the new IRS guidelines for 2025.

Effective strategies might include grouping deductions, accelerating expenses, and optimizing charitable contributions. Let’s examine some methods for leveraging these strategies to your advantage.

Grouping Deductions

Consider grouping deductible expenses into a single tax year to exceed the standard deduction. For instance, prepaying property taxes or medical expenses could provide significant deductions during that year.

Optimizing Charitable Contributions

Maximize charitable contributions by donating appreciated assets and using employer-matching gift programs. Be sure to retain proper documentation for all donations, as required by the IRS.

- Keep Detailed Records: Keep well-organized records of any pertinent documentation, such as receipts, invoices, and appraisals.

- Consult Tax Professionals: Work with a tax advisor for personalized advice based on changes in tax law. Optimize Timing: Group deductible expenses to exceed the standard deduction in a single tax year.

Employing these strategies requires a proactive approach to tax planning, but the potential savings can be substantial. By capitalizing on deductions and organizing your finances, taxpayers can maintain the best financial position possible.

Mastering strategies to maximize itemized deductions benefits taxpayers wishing to enhance savings under the new IRS guidelines for 2025. These planning strategies make a proactive step towards achieving tax efficiency and potential financial gains.

Navigating Changes to Home-Related Deductions

Homeownership often comes with tax benefits, but changes to home-related itemized deductions require careful consideration. Significant changes concerning deductions for mortgage interest, property taxes, and home improvements need to be considered.

The new IRS guidelines for 2025 may introduce updates that could impact how homeowners approach their tax filings. Assessing these changes can help homeowners optimize their deductions while remaining compliant.

Mortgage Interest Deductions

The IRS may adjust limits for deducting mortgage interest based on loan origination dates and amounts. Understanding the specific rules that apply to your mortgage is essential for claiming the full deduction.

Property Taxes and the SALT Cap

Given the $10,000 SALT cap, homeowners must strategically plan their property tax payments. Consider prepaying or accelerating payments to ensure you maximize deductions under current limits.

Homeowners that familiarize themselves with alterations to housing-related deductions empower themselves to make well-informed fiscal decisions. Maintaining compliance and realizing maximum savings are both achievable with vigilant monitoring.

Awareness of revisions to housing-related itemized deductions is a critical point for homeowners aiming to streamline their tax filings. Effective planning enables maximizing savings while staying within government regulations.

Planning Ahead for the 2025 Tax Year

Effective tax planning requires foresight. Taking proactive steps and making informed decisions throughout the year can help you navigate the new IRS guidelines for 2025 and optimize your tax outcome.

This includes reviewing financial records, consulting with professionals, and adjusting withholding. Through planning and diligent execution, you can position yourself advantageously for the upcoming tax season.

- Estimate Taxable Income: Forecast your income and potential deductions accurately.

- Review Withholding: Adjust withholding to align with your expected tax liability.

- Consult with a Tax Professional: Obtain personalized advice tailored to your situation.

Taking a proactive approach to tax planning can significantly enhance your financial well-being. Diligent monitoring and knowledgeable guidance will empower you to make sound financial choices.

Foresight is critical in tax planning to ensure compliance and possibly lower tax liability. Through meticulous planning and proactive decision-making, one can successfully tackle the changes ahead for the new tax year.

| Key Point | Brief Description |

|---|---|

| 💰 Medical Expense Threshold | Deductible medical expenses must exceed 7.5% of your AGI. |

| 🏠 SALT Deduction Cap | State and Local Tax (SALT) deduction remains capped at $10,000. |

| 🏡 Home Mortgage Interest | Deduct interest paid on mortgage debt, subject to certain limits. |

| 🙏 Charitable Contributions | Deduct donations to qualified charities up to a percentage of your AGI. |

Frequently Asked Questions (FAQ)

▼

The standard deduction amounts typically change annually based on inflation adjustments. For tax year 2025, taxpayers should refer to the latest IRS guidelines for specific amounts based on filing status.

▼

Compare your total itemized deductions to the standard deduction amount for your filing status. If your itemized deductions exceed the standard deduction, it’s generally more beneficial to itemize.

▼

Retain receipts, cancelled checks, invoices, and any other documentation supporting your claimed itemized deductions. These documents are essential in the event of an IRS audit.

▼

Official IRS publications and the IRS website (irs.gov) are reliable sources for the latest guidelines. Consult these resources or seek professional tax advice for accurate and up-to-date information.

▼

The SALT deduction, capped at $10,000 per household, reduces your federal taxable income by the amount of state and local taxes you pay, including property, income, and sales taxes.

Conclusion

Understanding the new IRS guidelines for 2025 and their impact on itemized deductions is crucial for taxpayers aiming to optimize their tax returns. By staying informed, planning strategically, and seeking professional advice, individuals and families can navigate these changes effectively and ensure compliance while maximizing potential tax savings.