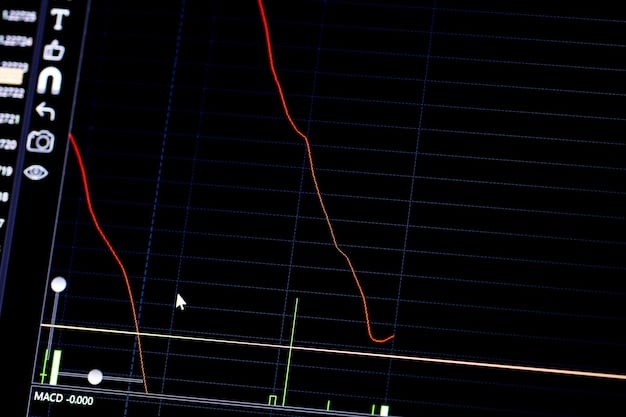

Stock Market Plunge: Dow Jones Suffers 500-Point Drop Amid Uncertainty

Stock market volatility surged as the Dow Jones Industrial Average plummeted 500 points amidst escalating global economic uncertainty, influenced by factors such as rising inflation and geopolitical tensions.

The stock market experienced a jolt today as the Dow Jones Industrial Average took a significant hit, dropping 500 points. This downturn reflects growing unease in the face of multifaceted global uncertainties, making stock market volatility: Dow Jones drops 500 points amid global uncertainty a key concern for investors.

Understanding Stock Market Volatility

Stock market volatility refers to the degree of variation in trading prices over a given time. It’s essentially how much and how quickly the market and individual stocks move up or down. High volatility can signal uncertainty and fear, while low volatility often indicates a more stable, bullish market. Several factors can contribute to increased market volatility, and it’s important for investors to understand these to make informed decisions.

Key Indicators of Market Volatility

Several indicators provide insights into market volatility. These include the VIX (Volatility Index), which measures market expectations of near-term volatility based on S&P 500 index options, and historical volatility, which looks at past price fluctuations to gauge potential future movements.

Factors Influencing Investor Sentiment

Investor sentiment plays a crucial role in market volatility. News events, economic data releases, and geopolitical developments can all impact how investors feel about the market, leading to buy or sell decisions that exacerbate price swings.

- Geopolitical tensions can create uncertainty and lead to increased volatility.

- Surprising economic data, such as inflation reports, can trigger sharp market reactions.

- Changes in interest rates by central banks can influence borrowing costs and corporate profitability.

Understanding the underlying factors and indicators of stock market volatility is essential for investors to navigate uncertain times. By keeping an eye on these elements, investors can better assess risk and make informed decisions to protect their portfolios.

The Dow Jones Industrial Average: A 500-Point Decline

The Dow Jones Industrial Average (DJIA) is a price-weighted index that tracks 30 large, publicly owned blue-chip companies trading on the New York Stock Exchange (NYSE) and the Nasdaq. A 500-point drop in the Dow is considered a significant movement that often captures headlines and raises concerns among investors. This decline can be attributed to various market pressures.

Impact of the Drop on Investors

For investors, a 500-point drop in the Dow can be unsettling, especially for those with short-term investment horizons. The immediate impact can be seen in portfolio values, potentially leading to panic selling. However, it’s important to remember that market corrections are a normal part of the economic cycle.

Historical Significance of Similar Drops

Historically, the Dow has experienced significant drops for various reasons, from economic recessions to unexpected global events. While each decline is unique, analyzing these historical instances can provide context and perspective. For instance, the 2008 financial crisis saw multiple days of significant losses, highlighting systemic risks in the financial system.

- Reviewing historical market downturns can help investors understand potential recovery timelines.

- Analyzing the causes of past drops can provide insights into current market risks.

- Understanding typical market behavior during periods of volatility can reduce emotional reactions.

A 500-point drop in the Dow Jones is undoubtedly a noteworthy event, but understanding its potential impact and historical context can help investors make rational decisions rather than reacting emotionally.

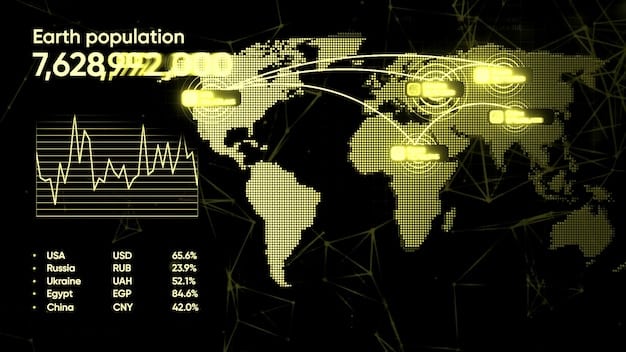

Global Uncertainty: The Catalyst?

Global uncertainty significantly contributes to **stock market volatility: Dow Jones drops 500 points amid global uncertainty**. Events such as geopolitical tensions, changes in international trade policies, and unexpected economic downturns in major economies can all trigger market instability. These factors often create a domino effect, impacting investor confidence and leading to widespread sell-offs.

Geopolitical Risks and Market Reaction

Geopolitical risks, such as conflicts, political instability, and diplomatic crises, can have a profound impact on financial markets. Investors tend to become risk-averse during these times, moving their assets to safer havens like government bonds or gold.

Economic Indicators and Their Influence

Economic indicators, such as GDP growth, inflation rates, and unemployment figures, play a crucial role in shaping market expectations. Surprising or unfavorable data can quickly erode investor confidence, leading to sell-offs.

- Rising inflation can prompt central banks to raise interest rates, impacting corporate earnings.

- Trade wars can disrupt supply chains and reduce corporate profitability.

- Economic slowdowns in major economies can lead to decreased global demand.

Global uncertainty acts as a significant catalyst for stock market volatility. By understanding the various sources of this uncertainty and their potential impact, investors can better prepare for and navigate turbulent market conditions.

Interest Rates and the Federal Reserve

Interest rates, particularly those set by the Federal Reserve (the Fed), are critical drivers of stock market performance. The Fed uses interest rates to manage inflation and stimulate economic growth. When the Fed raises rates, borrowing becomes more expensive, which can slow down economic activity and potentially lead to a market downturn.

The Fed’s Monetary Policy Decisions

The Federal Reserve’s monetary policy decisions are closely watched by investors and analysts. These decisions are based on assessments of current economic conditions and forecasts for future growth and inflation. Changes in interest rates can have both immediate and long-term effects on the stock market.

Impact on Corporate Borrowing and Growth

Higher interest rates increase the cost of borrowing for corporations, which can reduce investment in new projects and expansion. This, in turn, can lead to slower earnings growth and lower stock valuations.

The Federal Reserve’s decisions on interest rates have a profound impact on stock market volatility. Investors must stay informed about these policies and their potential implications to make informed investment decisions.

Strategies for Navigating Volatile Markets

Navigating volatile markets requires a strategic approach. Investors should consider several strategies to protect their portfolios and potentially capitalize on opportunities that arise during periods of uncertainty. Diversification, maintaining a long-term perspective, and using hedging strategies are some effective methods.

Diversification as a Risk Management Tool

Diversification involves spreading investments across different asset classes, sectors, and geographic regions. This can help reduce the impact of any single investment performing poorly, thus mitigating overall portfolio risk.

The Importance of a Long-Term Perspective

Adopting a long-term perspective is crucial for weathering market volatility. Trying to time the market can be risky and often leads to poor investment decisions. Instead, focusing on long-term goals and staying invested can help investors benefit from the market’s eventual recovery.

Successfully navigating volatile markets requires a combination of strategic planning and disciplined execution. By diversifying investments, maintaining a long-term perspective, and considering professional advice, investors can better manage risk and achieve their financial goals.

Expert Opinions and Market Forecasts

Expert opinions and market forecasts provide valuable insights into potential future market movements. Economists, analysts, and investment strategists offer different perspectives based on their analysis of economic data, market trends, and global events. While no forecast is perfect, considering a range of opinions can help investors make more informed decisions.

Analyzing Expert Commentary

Various experts offer commentary on the current market situation and potential future developments. Their insights can provide a broader understanding of the factors driving market volatility and potential opportunities.

- Economists often provide macroeconomic forecasts and analysis.

- Market analysts focus on technical indicators and market trends.

- Investment strategists offer guidance on portfolio allocation and risk management.

Using Forecasts to Inform Investment Decisions

While market forecasts should not be the sole basis for investment decisions, they can be a valuable input. Investors should consider multiple forecasts and assess the underlying assumptions and methodologies.

Incorporating expert opinions and market forecasts into investment analysis can enhance decision-making. By considering a range of perspectives, investors can better assess risks and opportunities in volatile markets.

| Key Point | Brief Description |

|---|---|

| ⚠️ Dow’s Decline | The Dow Jones dropped 500 points, indicating significant market volatility amid global uncertainties. |

| 🌍 Global Uncertainty | Geopolitical risks and economic indicators like inflation influence market instability. |

| 📈 Interest Rates | Federal Reserve’s rate decisions impact borrowing costs and market performance. |

| 🛡️ Navigating Markets | Diversify investments and maintain a long-term view to weather volatility. |

Frequently Asked Questions

▼

Stock market volatility can be caused by various factors, including economic data releases, geopolitical events, and changes in investor sentiment. These events can lead to increased buying or selling pressure, causing prices to fluctuate.

▼

The Dow Jones Industrial Average (DJIA) is a price-weighted index that tracks 30 large, publicly owned blue-chip companies trading on the NYSE and Nasdaq. Its value is calculated based on the stock prices of these companies.

▼

The Federal Reserve manages monetary policy, including setting interest rates, to promote economic stability. Changes in interest rates can influence borrowing costs and overall economic activity, impacting market performance.

▼

Investors can use several strategies, such as diversification, maintaining a long-term perspective, and consulting with financial advisors. These methods can help mitigate risk and navigate market uncertainty effectively.

▼

Staying informed involves following reputable financial news sources, monitoring economic indicators, and consulting with financial professionals. Regularly reviewing your investment portfolio is also crucial for adapting to market changes.

Conclusion

In summary, the recent 500-point drop in the Dow Jones Industrial Average underscores the impact of global uncertainties and economic factors on stock market volatility. Investors should remain informed, adopt strategic approaches and consult expert advice to navigate these turbulent times effectively.