Stock Market Volatility: Dow Jones Plunge Explained

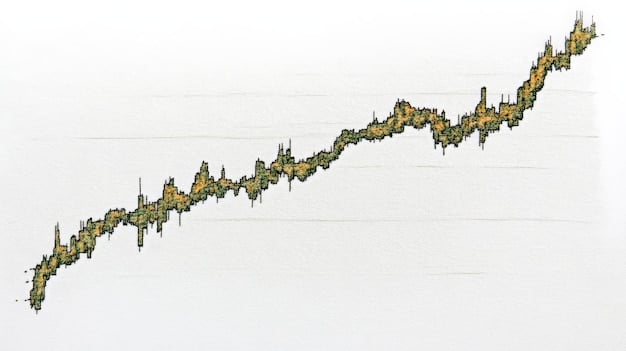

Stock market volatility surged as the Dow Jones experienced a significant 500-point swing, driven by factors such as inflation concerns, rising interest rates, and geopolitical tensions, leading investors to re-evaluate their positions amidst growing economic uncertainty.

The stock market has been a rollercoaster lately, and the recent stock market volatility: Dow Jones experiences 500-point swing – what’s driving the uncertainty? leaves many investors wondering what’s next. This article dives into the reasons behind the market’s jitters and what it could mean for your portfolio.

Understanding the Dow’s Dramatic Dip

The Dow Jones Industrial Average, a key indicator of the overall stock market health, recently experienced a sharp drop. This kind of movement can cause alarm, but understanding the forces behind it is the first step towards navigating the situation.

Immediate Triggers for the Downturn

Several factors can trigger a sudden downturn in the stock market. These can include economic reports suggesting a slowdown, unexpected political events, or even investor sentiment shifts.

Broader Economic Context

It’s important to consider the broader economic context when analyzing a market dip. Factors like inflation, interest rates, and global economic growth all play a significant role.

- Inflation rates impacting consumer spending.

- Federal Reserve’s actions on interest rates.

- Global supply chain disruptions.

Market volatility, as evidenced by the Dow’s recent plunge, serves as a reminder of the intrinsic uncertainties embedded within stock investments. Such fluctuations are shaped by a complex interplay of immediate events and larger economic factors.

Unpacking the Underlying Causes of Market Volatility

While specific events may trigger a drop, the underlying causes of market volatility are often more complex and deeply rooted in the economic landscape.

Inflationary Pressures

Rising inflation is a major concern for investors. When prices increase, it erodes purchasing power and can lead to decreased corporate earnings.

Interest Rate Hikes

The Federal Reserve raising interest rates to combat inflation can also impact the stock market. Higher interest rates make borrowing more expensive for companies and consumers.

Geopolitical Instability

Global political events, such as wars, trade disputes, and political instability, can create uncertainty and send ripples through the stock market.

- Impact of geopolitical events on investor confidence.

- How trade tensions affect multinational corporations.

- The role of political instability in emerging markets.

Understanding the underlying causes of market volatility, such as inflationary pressures, interest rate hikes, and geopolitical instability, is essential for making informed investment decisions. These factors can significantly impact investor sentiment and market performance.

The Role of Investor Sentiment

The stock market isn’t solely driven by hard data; investor sentiment plays a crucial role. Fear and uncertainty can lead to panic selling, while optimism can fuel rallies.

Fear and Panic Selling

A sudden drop in the market can trigger fear and panic selling, leading to a further decline as investors rush to exit their positions.

Herd Mentality

Investors often follow the crowd, leading to herd mentality. This can amplify market movements, both positive and negative.

The Influence of News and Media

News headlines and media coverage can significantly influence investor sentiment. Negative news can exacerbate fears and lead to selling pressure.

Investor sentiment, influenced by fear, herd mentality, and media coverage, is a critical driver of market volatility. This can lead to unpredictable market movements, separate from underlying economic soundness.

Strategies for Navigating a Volatile Market

While market volatility can be unsettling, it also presents opportunities for savvy investors. Here are some strategies to consider.

Long-Term Investing

Focus on long-term investing, which involves holding assets for an extended period. This strategy can help you weather short-term market fluctuations.

Diversification

Diversify your portfolio across different asset classes, sectors, and geographic regions. This can help mitigate risk and reduce the impact of market volatility on your overall investments.

Dollar-Cost Averaging

Implement dollar-cost averaging, which involves investing a fixed amount of money at regular intervals, regardless of market conditions. This strategy can help you buy low and reduce the risk of timing the market.

- Benefits of a long-term perspective.

- How diversification reduces overall portfolio risk.

- The advantages of consistent investing through dollar-cost averaging.

Navigating a volatile market requires a strategic approach, including long-term investing, diversification, and dollar-cost averaging. These strategies can help investors mitigate risk and capitalize on potential opportunities during market fluctuations.

Understanding Market Corrections and Bear Markets

It’s important to differentiate between a market correction, a bear market, and normal market fluctuations. Each has different implications for investors.

Market Correction

A market correction is a decline of 10% or more in the stock market. Corrections are relatively common and often short-lived.

Bear Market

A bear market is a decline of 20% or more in the stock market. Bear markets are less frequent than corrections and can last for several months or even years.

Recovery Patterns

Understanding historical recovery patterns following market corrections and bear markets can provide valuable insights into potential future performance.

Distinguishing between market corrections and bear markets is crucial for informed investment decisions. Market corrections are typically shorter and less severe, whereas bear markets involve more substantial declines and longer recovery periods.

Seeking Professional Advice

Navigating a volatile market can be challenging, especially for investors with limited experience. Seeking professional financial advice can be invaluable.

The Benefits of a Financial Advisor

A financial advisor can provide personalized guidance based on your individual financial goals, risk tolerance, and time horizon.

Choosing the Right Advisor

When choosing a financial advisor, look for someone who is experienced, qualified, and has a fiduciary duty to act in your best interest.

Understanding Investment Options

A professional can help you understand the various investment options available and choose those that align with your specific needs.

- Expert financial planning and guidance.

- How to select a trustworthy and qualified advisor.

- The importance of understanding diverse investment choices.

Seeking professional financial advice provides investors with personalized guidance and expertise to navigate volatile markets effectively. A qualified advisor can help align investment strategies with individual financial goals and risk tolerance.

| Key Point | Brief Description |

|---|---|

| 📉 Dow Drop | 500-point swing, causing investor uncertainty. |

| 🔥 Inflation | Rising prices erode purchasing power. |

| 🛡️ Diversification | Spread investments to mitigate risk. |

| 📈 Long-Term | Focus on holding assets for long-term growth. |

Frequently Asked Questions (FAQ)

▼

Stock market volatility arises from numerous factors including economic news, political events, investor sentiment, and interest rate changes, all of which can trigger significant price fluctuations.

▼

Inflation can negatively affect the stock market by reducing consumer spending and corporate profits, as well as prompting the Federal Reserve to raise interest rates.

▼

Dollar-cost averaging involves investing a fixed sum of money regularly, irrespective of market conditions, helping to reduce the average cost per share over time.

▼

A market correction refers to a 10% or greater drop in the stock market, often occurring rapidly and typically lasting for a shorter duration than a bear market.

▼

Diversification is crucial because it spreads investment risk across various asset classes, reducing the impact of any single investment’s poor performance on the entire portfolio.

Conclusion

Understanding stock market volatility: Dow Jones experiences 500-point swing – what’s driving the uncertainty? requires a multi-faceted approach, considering economic indicators, investor sentiment, and global events. By staying informed and adopting sound investment strategies, investors can navigate these turbulent times and position themselves for long-term success.