Treasury Yields Soar to 4.8%: Impact on Bond Investors in US

Treasury yields have surged to 4.8%, signaling potential shifts in investment strategies for bond investors, influenced by economic growth, inflation expectations, and Federal Reserve policies.

The recent surge in Treasury yields to 4.8%: What Does This Mean for Bond Investors? has sent ripples through the financial markets, prompting both concern and strategic adjustments. Understanding the drivers and implications of this increase is crucial for navigating the complexities of fixed-income investments.

Understanding the Anatomy of Treasury Yields

Treasury yields are the return an investor receives from holding a U.S. government bond until maturity. These yields serve as a benchmark for other interest rates, influencing everything from mortgage rates to corporate bond yields. When Treasury yields rise, it generally indicates a shift in investor sentiment or broader economic conditions.

Factors Influencing Treasury Yields

Several factors can drive Treasury yields higher. These include:

- Economic Growth: Strong economic data often leads to higher yields as investors anticipate increased inflation and, consequently, higher interest rates.

- Inflation Expectations: Rising inflation erodes the real value of fixed-income investments, prompting investors to demand higher yields to compensate.

- Federal Reserve Policy: The Federal Reserve’s decisions on interest rates and quantitative easing directly impact Treasury yields. Hawkish policies (raising rates or tapering asset purchases) tend to push yields up.

In the current scenario, a combination of robust economic indicators, persistent inflation, and expectations of continued hawkish monetary policy have contributed to the surge in Treasury yields.

Immediate Impacts on Bond Investors

The immediate impact of rising Treasury yields on bond investors is a decrease in the value of existing bonds. This is because newly issued bonds with higher yields become more attractive, reducing the appeal of older, lower-yielding bonds.

Mark-to-Market Losses

Bond investors, especially those holding bond funds or ETFs, may experience mark-to-market losses as the net asset value (NAV) of these funds declines. This doesn’t necessarily mean investors are losing money if they hold the bonds until maturity, but it can be unsettling to see portfolio values decrease.

Reinvestment Risk

While existing bondholders may face short-term losses, rising yields present opportunities for reinvestment. Investors can reinvest maturing bonds or coupon payments at higher rates, potentially increasing their overall returns over time.

For long-term investors, the strategy is less about panic and more about positioning for future gains through strategic reinvestment and diversification.

Navigating the Yield Curve

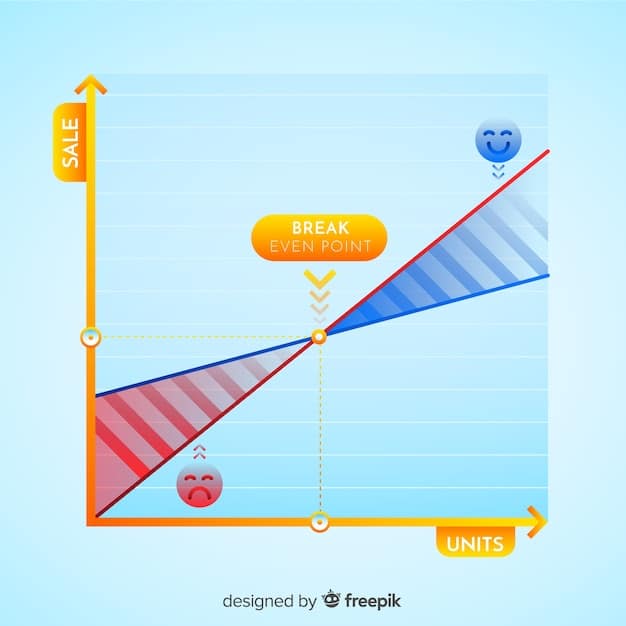

The yield curve, which plots yields of Treasury securities across different maturities, provides valuable insights into market expectations. Changes in the shape of the yield curve can signal potential economic shifts.

Understanding Yield Curve Inversions

An inverted yield curve, where short-term yields are higher than long-term yields, is often seen as a predictor of economic recession. This occurs when investors anticipate that the Federal Reserve will need to lower interest rates in the future to stimulate a slowing economy.

Steepening Yield Curve

A steepening yield curve, where the gap between short-term and long-term yields widens, typically indicates expectations of stronger economic growth and higher inflation. This environment can be favorable for riskier assets, such as stocks, as well as longer-duration bonds.

- Monitor economic indicators closely to anticipate shifts in the yield curve.

- Adjust bond portfolios based on yield curve expectations, tilting towards shorter or longer durations.

- Consider diversifying across different asset classes to mitigate risk in a changing yield environment.

The yield curve serves as a powerful tool that investors can use to adjust their overall investment approach.

Strategies for Bond Investors in a Rising Yield Environment

In a rising yield environment, bond investors can employ several strategies to mitigate risk and potentially enhance returns. These strategies involve actively managing bond portfolios to take advantage of changing market conditions.

Shortening Duration

One common strategy is to shorten the duration of a bond portfolio. Duration measures the sensitivity of a bond’s price to changes in interest rates. Shorter-duration bonds are less sensitive to interest rate increases, reducing potential losses.

Floating Rate Notes

Consider investing in floating rate notes, which have interest rates that adjust periodically based on a benchmark rate, such as the Secured Overnight Financing Rate (SOFR). These notes offer protection against rising interest rates, as their coupon payments increase along with yields.

These strategies are generally conservative and focus on capital preservation in a rising rate environment.

Impact on Different Bond Types

Rising Treasury yields affect different types of bonds in varying ways. Understanding these nuances is essential for tailoring investment strategies to specific risk tolerances and return objectives.

Corporate Bonds

Corporate bonds, which are issued by companies, typically offer higher yields than Treasury bonds to compensate investors for the additional credit risk. When Treasury yields rise, corporate bond yields also tend to increase, but the spread (the difference between corporate and Treasury yields) can fluctuate based on market sentiment and credit conditions.

Municipal Bonds

Municipal bonds, issued by state and local governments, offer tax advantages that can make them attractive to high-income investors. The impact of rising Treasury yields on municipal bonds depends on factors such as the overall supply of municipal bonds and the creditworthiness of the issuing entity.

Tailor your approach in alignment with your preferences, as these bonds appeal to different investors.

Long-Term Outlook and Considerations

The long-term outlook for Treasury yields depends on a range of factors, including economic growth, inflation expectations, and Federal Reserve policy. Investors should consider these factors when making long-term investment decisions.

Economic Projections

Assess economic projections from reputable sources, such as the Federal Reserve, International Monetary Fund (IMF), and private sector economists. These projections can provide insights into the expected path of economic growth and inflation, which will influence Treasury yields.

Inflation Trends

Monitor inflation trends closely, paying attention to indicators such as the Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) price index. Persistently high inflation could lead to further increases in Treasury yields as investors demand higher compensation for inflation risk.

Long-term strategies require a disciplined and flexible approach, capable of adapting to new information and market conditions.

| Key Point | Brief Description |

|---|---|

| 📈 Rising Yields | Treasury yields surged to 4.8%, impacting bond values. |

| 📉 Bond Values | Existing bonds decrease in value as yields rise. |

| 🔄 Reinvestment | Opportunities to reinvest at higher rates for better returns. |

| 📊 Yield Curve | Monitor yield curve for economic signals and adjust strategy. |

Frequently Asked Questions

▼

Treasury yields increase due to factors like economic growth, inflation expectations, and Federal Reserve policies. Strong economic data and rising inflation often lead to higher yields as investors demand more compensation for inflation risk.

▼

Rising Treasury yields typically cause bond prices to fall. This is because newly issued bonds offer higher yields, making older bonds with lower yields less attractive to investors, thus decreasing their market value.

▼

The yield curve plots yields of Treasury securities across different maturities. Its shape indicates market expectations about future economic conditions; an inverted curve often signals a potential economic recession.

▼

Strategies include shortening duration, investing in floating rate notes, and diversifying across different bond types. These tactics help mitigate risk and potentially enhance returns in a rising yield environment.

▼

Economic projections, especially those related to growth and inflation, significantly influence Treasury yields. Positive projections tend to push yields higher as investors anticipate increased inflation and higher interest rates.

Conclusion

The surge in Treasury yields to 4.8% presents both challenges and opportunities for bond investors. By understanding the underlying factors driving these changes and implementing appropriate strategies, investors can navigate the complexities of the fixed-income market and position their portfolios for long-term success.