Understanding Tax Audits: A Comprehensive Guide for US Taxpayers

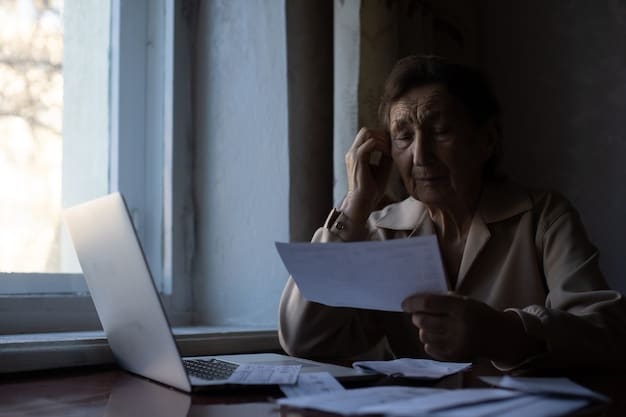

Understanding tax audits is crucial for US taxpayers; this guide explains what to expect during an audit and provides essential preparation tips to navigate the process confidently and minimize potential stress.

Navigating the world of taxes can be complex, and the prospect of a tax audit can be daunting. Understanding tax audits: what to expect and how to prepare is vital for every US taxpayer. This article aims to demystify the audit process, providing clarity and actionable steps to help you approach an audit with confidence.

What Triggers a Tax Audit?

Understanding the common triggers for a tax audit can help you minimize your risk. While the IRS doesn’t disclose all audit triggers, some red flags can increase your chances of being selected for an audit. Knowing these triggers allows you to be more diligent in your tax preparation and documentation.

High Income

Taxpayers with higher incomes are statistically more likely to be audited. The IRS often scrutinizes high-income returns more closely to ensure all income is reported and deductions are legitimate.

Discrepancies between Reported Income

Inconsistencies between the income you report and what’s reported to the IRS by employers, banks, or other institutions can raise a red flag. It’s crucial to ensure that all W-2s, 1099s, and other income documents match the information on your tax return.

- Double-check all income documents against your tax return.

- Report all sources of income, even if they seem insignificant.

- Keep records of all income received and reported.

By being aware of these potential triggers and diligently preparing your tax returns, you can reduce the likelihood of an audit. Keeping accurate records and seeking professional advice can further protect you from unwanted scrutiny.

Types of Tax Audits

Tax audits come in different forms, each with its own procedures and requirements. Understanding the type of audit you’re facing is crucial for preparing effectively and responding appropriately. There are three main types of tax audits: correspondence audits, office audits, and field audits. Each requires a different level of preparation and interaction with the IRS.

Correspondence audits are the simplest and most common type, typically addressing straightforward issues through the mail. Office audits require you to visit an IRS office with your documents. Field audits, the most comprehensive, involve an IRS agent visiting your home or business.

Correspondence Audits

Conducted via mail, correspondence audits usually focus on specific, easily verifiable items. The IRS will send a letter requesting documentation to support a particular deduction, credit, or income item.

Office Audits

Office audits require you to meet with an IRS auditor at an IRS office. These audits are more in-depth than correspondence audits and may involve multiple issues. You’ll need to bring all relevant documents to the meeting.

- Carefully review the IRS notice to understand the specific issues being audited.

- Gather all relevant documents, such as receipts, bank statements, and tax forms.

- Arrive on time and be prepared to answer questions clearly and concisely.

Preparing for a Tax Audit: Documentation is Key

Proper documentation is crucial when preparing for a tax audit. The more organized and thorough your records, the better equipped you’ll be to support your tax return. This includes receipts, invoices, bank statements, and any other documents that substantiate your income, deductions, and credits.

Organizing Your Documents

Start by gathering all relevant documents and organizing them in a logical manner. Create separate folders for each category of income, deduction, and credit, such as “Business Expenses,” “Medical Expenses,” or “Charitable Contributions.” Ensure that each document is clearly labeled and easy to find.

Reconciling Your Records

Compare your records with the information reported to the IRS by third parties, such as employers and financial institutions. This will help you identify any discrepancies and resolve them before the audit. Ensure that all W-2s, 1099s, and other income documents match the information on your tax return.

By meticulously organizing your documents and understanding which ones are most important, you can streamline the audit process and minimize potential stress. Remember, thorough preparation is the key to a successful audit outcome.

What to Expect During the Audit Process

Understanding what to expect during the audit process can help alleviate anxiety and ensure you’re prepared for each step. From the initial notice to the final resolution, knowing the timeline and procedures involved can empower you to navigate the audit with confidence.

Initial Notice

The audit process begins with an initial notice from the IRS, typically sent via mail. This notice will specify the tax year being audited, the issues under review, and the documents or information needed. Read the notice carefully and respond promptly.

Responding to the IRS

Once you receive the audit notice, it’s crucial to respond to the IRS in a timely and professional manner. Ignoring the notice can lead to further complications, such as additional penalties or legal action. Send all correspondence via certified mail to ensure proof of delivery and keep copies for your records.

- Comply with all requests for information and documentation.

- Respond to the IRS within the specified deadlines.

- Keep a record of all correspondence and submissions.

By understanding each stage of the audit process and preparing accordingly, you can approach the audit with confidence and minimize potential stress. Remember, prompt and professional communication with the IRS is key to a smooth and successful audit outcome.

Your Rights as a Taxpayer During an Audit

As a taxpayer, you have specific rights that protect you during a tax audit. Understanding these rights ensures that you are treated fairly and respectfully throughout the process. The IRS is obligated to inform you of these rights and adhere to them during the audit.

Right to Representation

You have the right to be represented by a qualified professional, such as a tax attorney, CPA, or enrolled agent. Your representative can communicate with the IRS on your behalf, attend meetings, and negotiate a resolution.

Right to a Fair and Impartial Audit

You have the right to a fair and impartial audit conducted in accordance with IRS procedures. This means the auditor must be objective, unbiased, and follow established guidelines.

- Ensure that the auditor is following proper procedures.

- Request clarification if you don’t understand something.

- Keep a record of all interactions with the auditor.

Knowing your rights and asserting them appropriately can help ensure a fair and just outcome. Don’t hesitate to seek professional assistance to protect your interests and navigate the audit process with confidence.

Potential Outcomes and How to Resolve Disputes

The outcome of a tax audit can vary depending on the findings of the IRS. Understanding the potential outcomes and how to resolve any disputes that may arise is crucial for protecting your financial interests and ensuring a fair resolution. There are several possible outcomes, ranging from no change to significant adjustments to your tax liability.

No Change

If the IRS review finds that your tax return is accurate and supported by your documentation, you will receive a “no change” letter. This means that no adjustments will be made to your tax liability.

Agreed-Upon Changes

If you agree with the changes proposed by the IRS, you can sign an agreement form and pay any additional taxes, penalties, and interest owed. This resolves the audit and brings closure to the process.

- Keep detailed records of all audit-related documents.

- Be prepared to provide additional information or documentation if requested.

- Seek professional assistance if you are unsure about how to proceed.

| Key Point | Brief Description |

|---|---|

| 📝 Documentation | Keep detailed records to support your tax return. |

| 🗣️ Communication | Respond promptly and professionally to IRS notices. |

| 🛡️ Rights | Understand your rights as a taxpayer during an audit. |

| 🤝 Professional Help | Consider seeking assistance from a tax professional. |

[Frequently Asked Questions]

▼

A tax audit is an examination of your tax return by the IRS to ensure that your reported income, deductions, and credits are accurate and comply with tax laws.

▼

The IRS typically notifies you of an audit by mail. The notice will specify the tax year being audited and the issues under review.

▼

You’ll need documents to support your income, deductions, and credits, such as W-2s, 1099s, receipts, bank statements, and other relevant records.

▼

Yes, you can represent yourself, but you also have the right to be represented by a qualified professional, such as a tax attorney or CPA.

▼

If you disagree with the audit results, you have the right to appeal the decision. You can file an appeal with the IRS or take your case to Tax Court.

Conclusion

Understanding tax audits: what to expect and how to prepare is essential for all US taxpayers. By maintaining thorough records, responding promptly to IRS notices, and knowing your rights, you can navigate the audit process with confidence and minimize potential stress. Consider seeking professional assistance to ensure a fair and accurate resolution.